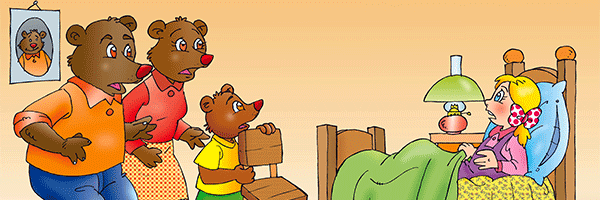

You can see yesterday’s stock rally and its continuation today as a return of the Goldilocks market.

Yesterday, for example, inflation, if you look just at core inflation–that is without food and energy prices–looked strong enough to make the Federal Reserve very cautious about removing monetary stimulus from the economy, but core inflation wasn’t so strong that it sent up warning flares.

And today, the drop in initial claims for unemployment to 293,000 (for the week ended October 9) for a new Pandemic low argues that the economy continues to improve but that the economy in general and the job market in particular are neither too hot nor too cold.

In other words a Goldilocks scenario. Even it there’s nothing in any trend to get all that excited about–it’s hard to point to a catalyst that will push stocks already trading at near all-time highs to even higher highs–there’s also nothing in these numbers to disrupt current comfort.

But Goldicocks faces a number of bearish challenges in the next few weeks.

First, there’s earnings season, which gets seriously underway in the week after next. Warnings from companies that point to rising raw materials costs–will Deere (DE) and Caterpillar (CAT), for example, express concern over rising steel prices?–might prompt a “This porridge is too cold” reaction.

And then there’s the Federal Reserve’s November meeting (on an early November 3 schedule this month). The Fed is widely expected to announce that beginning of a reduction in the monthly $120 billon of Treasuries and mortgage-backed assets that it has been buying. Will the schedule for a taper be very gradual or aggressive? Will the bed be too soft or too hard?

And how about the basic chair supporting the economy, consumer spending? The Pandemic stimulus measures that have boosted consumer spending are pretty much history now. Will signs–still very vague–that consumers are reining in spending just a little turn into something more?

If I were a little blond girl roaming around a strange house in the woods, I’d be very, very careful right now.